In this article, I’ll guide you on how to submit the Crocoblock Affiliate tax form. From now, all our affiliates need to fill out the tax form to receive affiliate payout.

Table of Contents:

😭 Yeah, I know it may sound complicated, but let me lead you step-by-step in this tutorial. And, if you have any questions or suggestions, don’t hesitate to reach out.

Why do you need to fill in this form?

Since Crocoblock project is part of Jetimpex Inc. and is registered in the US, we need to have our Affiliate’s tax information on file. We will use the information you provide with the best industry-standard practices and store your data securely.

Also, please note that the information you provide in your tax form should match your payment details. Otherwise, we can’t proceed with payment.

How to Submit Crocoblock Affiliate Tax Form

If you are still not a Crocoblock Affiliate, feel free to register and submit the form during the registration process.

In case you are an existing Affiliate, to submit the affiliate tax form, go to your Crocoblock Affiliate Account. Then go to the Tax Info tab and follow the instructions.

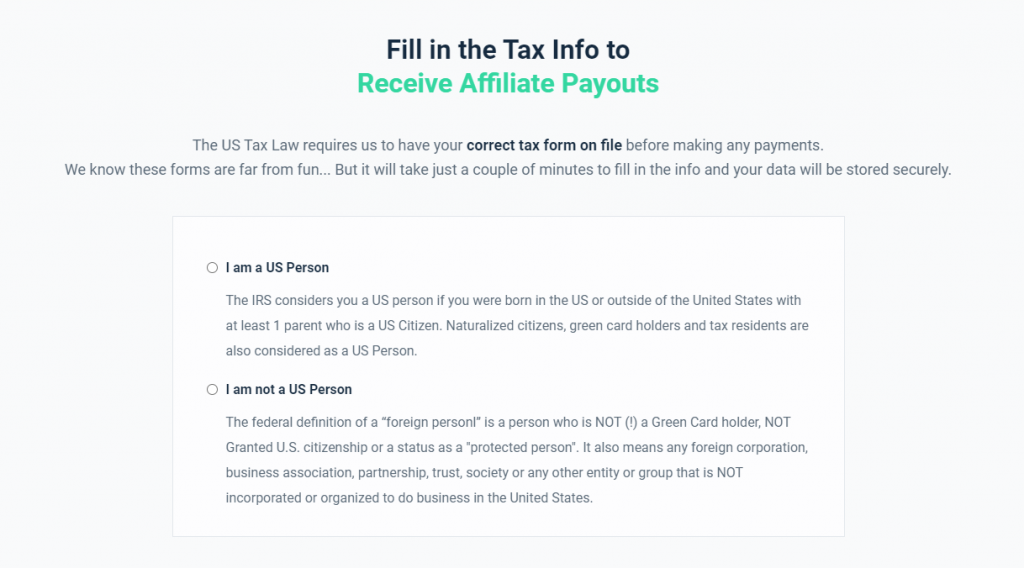

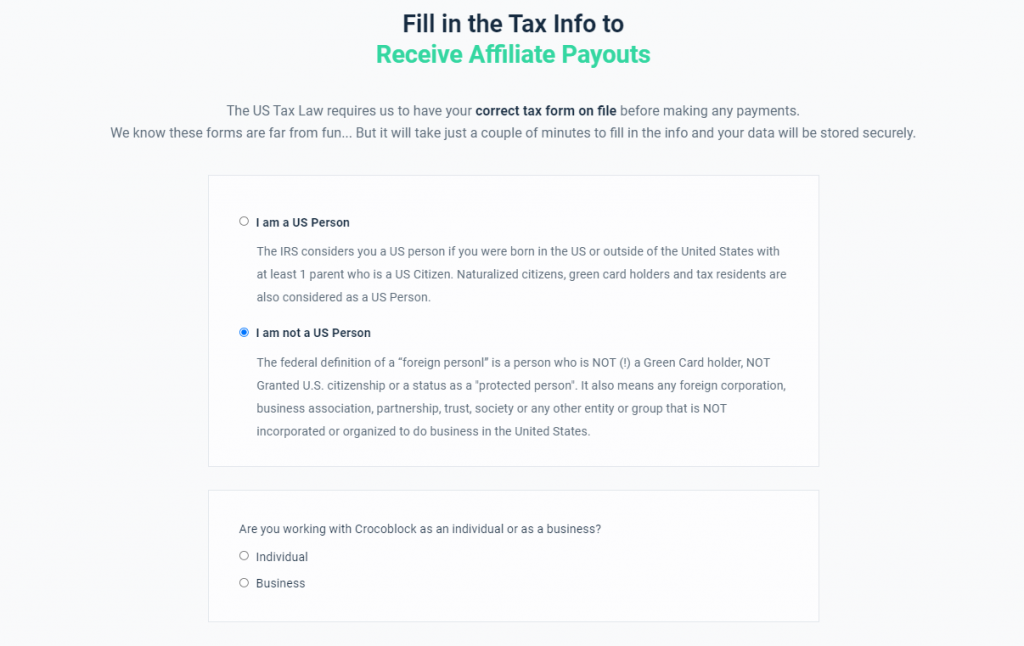

Let’s get started with choosing your location. There are two options available:

- US Citizen

- Non-US Citizen

US Citizen is the one who:

- Born in the US

- Born outside the United States with at least 1 parent (who is US Citizen)

- Naturalized citizens

- Green card holders

- Tax residence

Non-US Citizen is a person who is not granted US citizenship, Green Card holder or a ‘protected person”. It’s also any foreign corporation, business, partnership, trust, society or any other entity/group that is not organized/incorporated to manage a business in the United States.

Choose the appropriate one and proceed with filling the form.

US Citizen

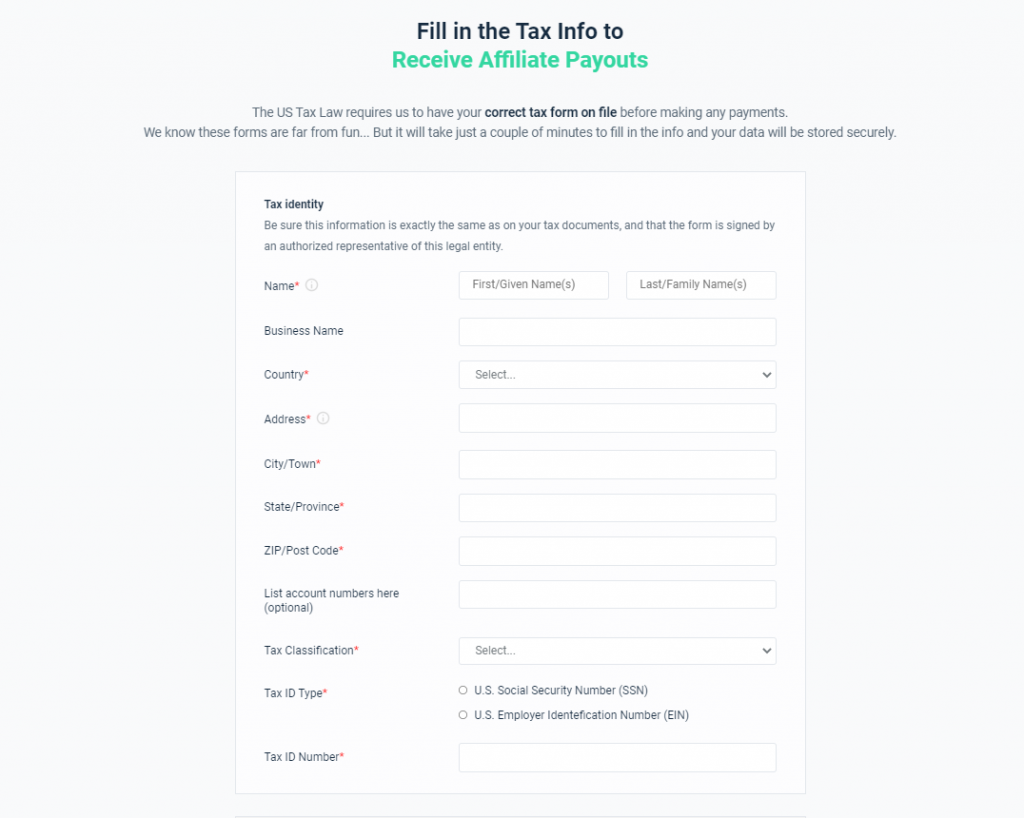

All United States Citizens need to fill out the W9 form.

General Information

Firstly, add your standard information: First and Last Name, Business Name optionally, Country, Address, City/Town, State/Province, ZIP/Postal code, List account numbers here (optional).

Then, choose the Tax Classification among 9 options:

- Individual

- C Corporation

- S Corporation

- Partnership

- Trust/Estate

- Limited Liability Company – C

- Limited Liability Company – S

- Limited Liability Company – P

- Other

After this, choose your Tax ID Type (Social Security Number or Identification Number), and pass your Tax ID Number.

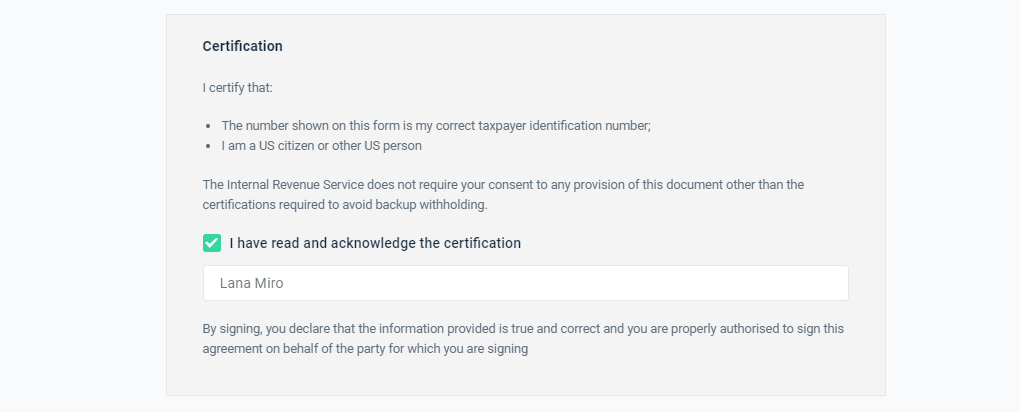

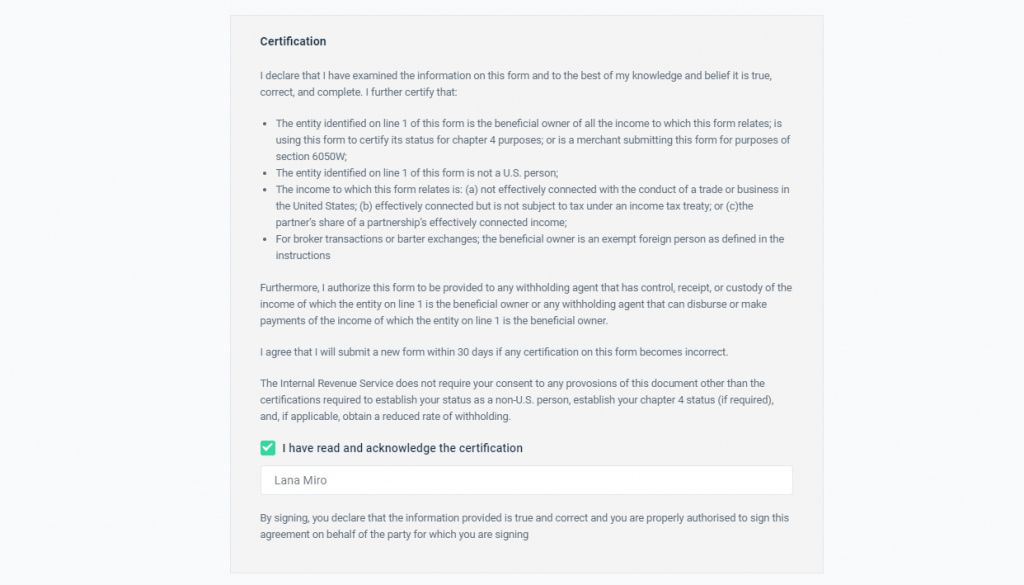

Certification

Next, have a look at the certification section to make sure your information is correct.

Form W9 is aimed to identify you as a US person, so it’s important to provide only correct information. Put your name in the signature field.

Success ✅

After the affiliate form submission, you’ll receive a success message. If any information is changed, go to your Affiliate Account and re-submit the form with the correct information.

Non-US Citizen

If you are located outside the United States, please choose “I’m not the US Person”, then pick the Individual or Business option.

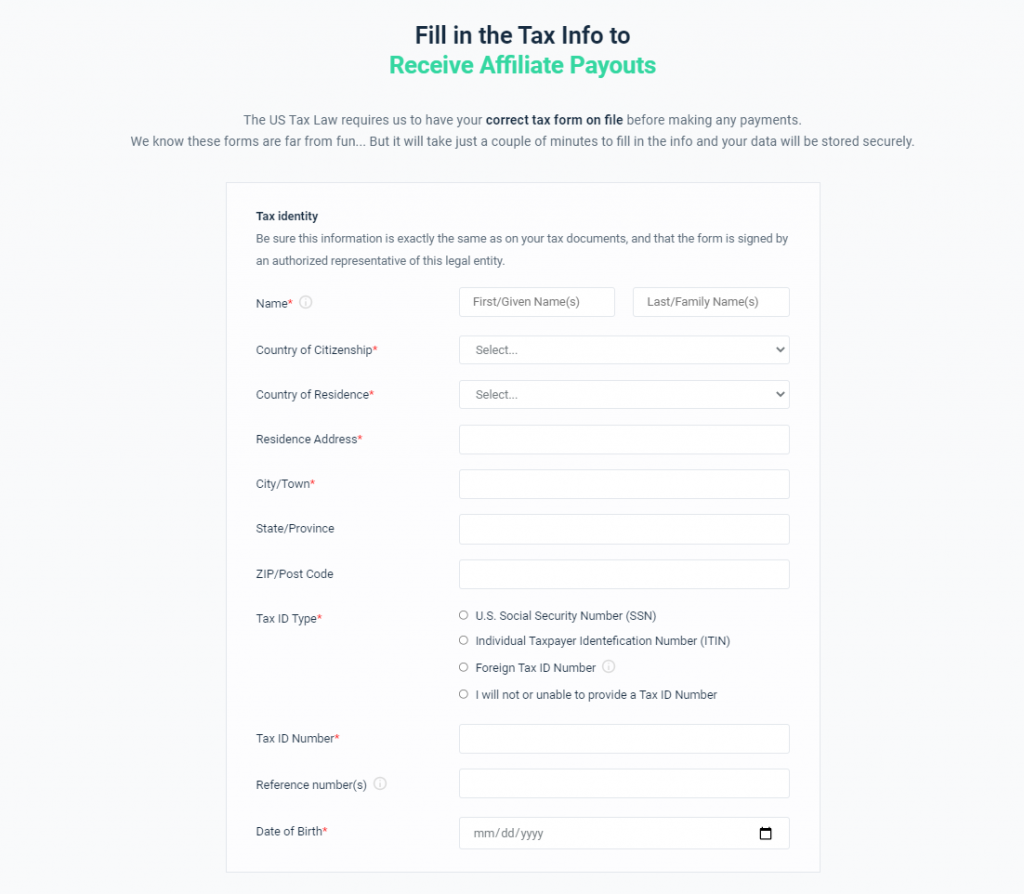

Individual Non-US Citizen

Simply provide general information first: Name, Country of Citizenship, Country of Residence, Address, City/Town, Date of Birth.

Optionally, State/Province and Zip/Post Code, Reference Number (alternative identifying information).

Then choose your Tax ID Type among 4 options:

- U.S. Social Security Number (SSN)

- Individual TaxPayer Identification Number (ITIN)

- Foreign Tax ID number (find out your ID number here)

- I will not or unable to provide a Tax ID Number

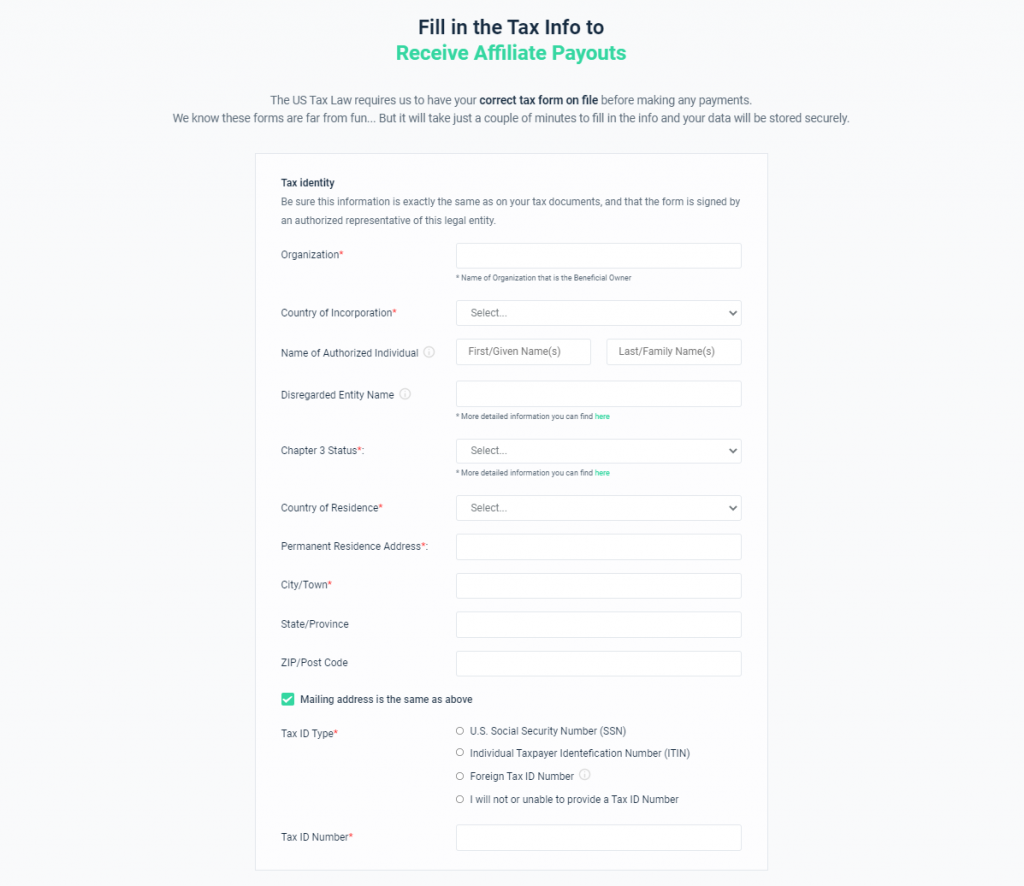

Business Non-US Citizen

Identify your business with the general information: Organization Name, Country (Location),

Optionally, Name of Authorized Individual (showed in your tax documents), Disregarded Entity Name (read more).

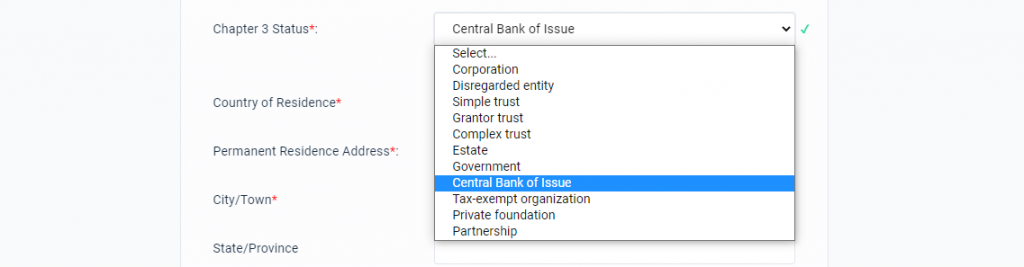

After this, choose Chapter 3 Status among 11 options:

Then choose your Country of Residence, Permanent Residence Address.

Afterward, select Tax ID Type and Number.

Proceed with certification, and you’re done! 💪

Certification

Confirm the provided information is correct and submit the form. There is also the option to re-submit the form in case of any inconvenience or changes.

Any Questions?

Do you still have any questions or suggestions? Don’t hesitate to drop the comment below or email me personally. Thank you for being a part of the Crocoblock Affiliate Family, and I wish to earn more with our Affiliate Program!