Whatever eCommerce platforms you are using to create your online store, payment Gateways always play a vital role in reducing abandoned cart for your store. If you decide to sell your products and services online with WooCommerce, you have to make a critical decision that will have a direct impact on your online sales: which WooCommerce payment gateway should you use?

In this article, I will share with you the background on WooCommerce payment gateway, the factors impacting the decision of payment options, and the top 5 best WooCommerce payment gateways.

- What Is a WooCommerce Payment Gateway?

- How Does a WooCommerce Payment Gateway Works?

- Factors To Consider Choosing the Best WooCommerce Payment Gateways

- Top 5 Best WooCommerce Payment Gateways

- Which WooCommerce Payment Plugin Is The Best?

What Is a WooCommerce Payment Gateway?

A payment gateway is a platform that handles all online transactions and allows you to receive payments. Customers send credit/debit card information at the end of the purchase, which is then communicated to the retailer and, finally, to the bank. Rather than going through the legal and financial requirements required to process money on your own, you can just sign up for a third-party payment gateway that will handle everything for you.

A WooCommerce payment gateway will also securely manage your clients’ credit card numbers, expiration dates, and other personal information. Payment gateways also reduce anonymity and increase the transparency of transactions.

The WooCommerce payment gateway’s function is thus to accept or deny a transaction with your WooCommerce store account before sending money into your bank account. To make online payments, you must have both a store account and an account of a payment gateway.

How Does a WooCommerce Payment Gateway Works?

Step 1: Sign up for an account with your preferred WooCommerce payment gateway.

Step 2: Connect the account mentioned above to your personal or corporate bank account.

Step 3: Connect the payment gateway to your WooCommerce store in step three. The majority of these WooCommerce payment gateways include plugins that allow you to connect them to your WooCommerce store.

Step 4: You are now ready to collect payments. When customers add a product to a cart on your WooCommerce store, the gateway opens a secure link to the payment processor. The transaction will then be approved, and WooCommerce will receive a success message, indicating that it is complete.

Step 5: Depending on the payment gateway you use, the funds will be transferred to your account either immediately or after a few days.

Factors To Consider Choosing the Best WooCommerce Payment Gateways

Before selecting a payment gateway for your WooCommerce store, you should consider the following requirements.

Transaction fees

Many WooCommerce payment gateways impose a fee for each transaction made on your website. It could be determined by the business’s location, the type of card used by customers, the payment gateway you select, and so on.

You can pass it on to clients by offering several payment channels with WooCommerce. To attract more clients, you should possibly lower your transaction charge than your competition.

Operational costs

In terms of other charges, determine whether the WooCommerce third-party payment gateway is appropriate and whether any additional fees are charged. Account maintenance fees or charges for bank withdrawals are examples of additional fees.

Payment methods

The more payment options your users have, the better. Because certain consumers will only be able to pay you through specific payment methods, it is preferable to cover as many as possible.

Credit cards and various e-wallets have become the standard payment options for internet purchases. A good payment gateway, on the other hand, should be able to accept other popular payment methods such as bank transfers, ACH payments, and PayPal.

Target countries and currencies

The third factor to consider when selecting a payment gateway is the availability of payment services in your country and in the target countries. It is also important to know whether the payment gateways support your target currencies or not. This information can be obtained from the plugin’s source or from the payment provider’s website.

For example, if the majority of your consumers are in Europe, you should look for a payment provider that is widely available and popular in the countries located in Europe and accept Euro.

In this case, you should go for the payment plugin that is operational and available in the locations where you and your clients live. Also, to reach more clients, ensure that it supports the majority of credit and debit card providers of both local and international currencies.

Security

Nothing is more crucial than security when it comes to payments. If your payment procedure is not secure, you expose both you and your clients to data loss and other problems. This encompasses technical, financial, and even legal issues.

Customers must trust you before they will purchase anything from you. By displaying a secure payment mechanism, you indicate that purchasing a product from you is safe and dependable.

In such cases, you should check and select a plugin that includes additional security and fraud protection features.

Recurring payments

Many companies want to market subscription-based products that require ongoing payments. Some payment gateways require clients to complete the transaction manually and do not accept recurring payments. It is possible that customers will return to your website in a loop. Before selecting the best WooCommerce payment gateways, make sure you check this box if your store requires auto-renewal options.

So If you want to sell subscription-based products with automatic renewal, search for a plugin that includes recurring payment options in addition to one-time payments.

These are only a few of the most significant things to look for. You may also wish to look at other things that your company may require. For example, simple refunds, ease of use, WooCommerce compatibility, verification, and GDPR compliance based on your location.

That being said, let’s look at some of the best WooCommerce payment gateways for you to consider adding to your online store.

Top 5 Best WooCommerce Payment Gateways

1. Stripe

Stripe is considered the most popular third-party payment gateway for WooCommerce, accepts credit card payments on your website. WooCommerce includes a built-in system that accepts Stripe as a payment gateway.

It becomes an excellent solution for those who are considering how to implement a custom payment gateway into their WooCommerce stores. It accepts all major credit and debit cards. Customers can also use Apple Pay, Google Pay, and Alipay to pay.

Stripe is available in over 40 countries and accepts over 135 currencies. With Stripe, you will not be charged any setup or annual fees. Stripe also accepts recurring payments and can be utilized with any subscription or membership plugin for WordPress.

Stripe operates in a white-label mode, which has the significant advantage of keeping your consumers at home rather than redirecting them to an external payment website. When we understand how important it is to make the buying experience as seamless as possible in order to reduce abandonment, this type of solution is unavoidable.

For significant numbers of transactions, it may be worthwhile to negotiate a reduction, but it may also be worthwhile to contact your bank to discuss a potentially more cost-effective option.

Stripe accepts recurring payments and can be utilized with any subscription or membership plugin for WordPress.

Fees:

- 4% tax on each transaction plus 0.25¢ for European cards

- 9% tax on each transaction plus 0.25¢ for non-European cards

Currency: Stripe supports processing payments in 135+ currencies.

Country: Stripe is supported in 40 countries.

Pros

- Excellent customer support

- Acceptable costs

- Developer-friendly

Cons

- Not available in all countries

- Not easy to use and set up for the beginners

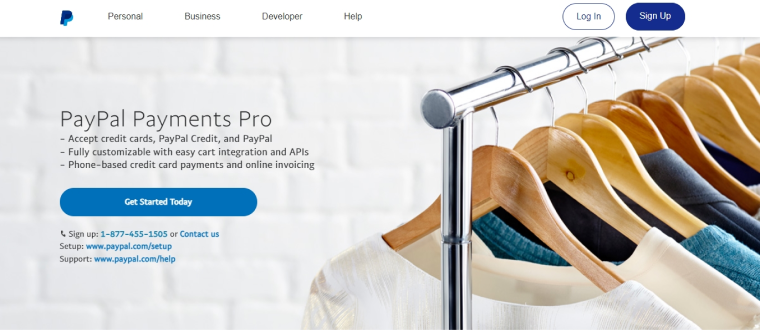

2. PayPal Pro

PayPal is one of the world’s first payment services, and as such, it is ubiquitous. The bottom line is straightforward: it is a one-stop online payment gateway. Users provide them with access to all of their credit cards, bank accounts, and addresses, and they are ready to shop at your store.

PayPal is also extremely secure, with numerous anti-fraud features such as Automatic fraud screening and their Seller Protection Policy. PayPal provides total buyer and seller protection by allowing you to go through particular and well-defined dispute resolution methods.

Your PayPal dashboard has all the information you require. With a few mouse clicks and the execution of a few reports, you may export almost any data you require in PDF, CSV, TAB, or QuickBooks format.

However, PayPal pro does not support recurring payments, and it involves a monthly charge, and transaction fees vary by country. This can make the cost of starting a new business with PayPal Pro higher than other payment options.

Fees

- 9% + 30¢ per transaction for local payments.

- 9% transaction fee for international payments.

Currency: PayPal pro accepts more than 20 currencies including both international currency like USD, and the local ones such as GBP, AUD, CAD, etc.

Country: PayPal Pro is available for businesses in more than 200 countries.

Pros

- Universally familiar to most people

- Simple to set up and use

- Available in most countries throughout the world.

Cons

- Less developer-friendly

- Monthly fees

- More suitable for bigger companies

3. Authorize.Net

Authorize.Net, a well-known WooCommerce payment gateway, has evolved into an enterprise-friendly solution similar to PayPal and Square. Your website can also accept credit card payments.

Authorize.Net, a popular WooCommerce extension, offers your customers a secure credit card checkout alternative. When a customer is in the middle of a transaction, they do not abandon your website. As a result, it assures a safe transaction for your customers. It is a user-friendly platform that allows consumers to save and reuse their payment methods. Authorize.Net and WooCommerce can be integrated in a straightforward manner.

Authorize.net offers an easy-to-use dashboard that organizes all of your payments into a grid that you can use to capture payments and process refunds in a matter of seconds. In addition to full payments, the plugin allows you to execute partial refunds.

Finally, Authorize.net allows you to easily customize your payment page by changing the payment method title, order button text, displaying preferred cards on the checkout page, and activating the CVV number on the checkout page.

Fees: The plugin will cost you $79 once for a single site. The license provides one year of support and updates.

Country: The plugin currently supports the United States, United Kingdom, Europe, Australia, and Canada.

Pros

- Backed by Visa

- Extensive reporting features

- Lower rates for higher volumes

Cons

- Only used in the US and Canada

- Difficult to set up

- Not suitable for small businesses

4. Square

Square is an excellent payment option for small businesses that sell physical goods, particularly local small businesses. Square offers its users a well-designed and user-friendly interface. Square allows you to accept credit cards, Apple Pay, and Google Pay.

Square, like PayPal, has variable transaction fees. The biggest advantage of using Square is that it allows visitors to utilize their preferred mobile payment methods. Mobile payments are the most efficient way to advance in the row. When it comes to mobile payments, Square appears to be the finest payment gateway for WooCommerce.

Square is now available in the following countries: the United States, Canada, Australia, Japan, and the United Kingdom. The transaction cost varies by country, but there is a set transaction rate.

To sync products, the WooCommerce Square Extension connects your website and your Square account. You can also add products to your Square account, and they will display in your WooCommerce store automatically.

Fees: 2.9% + 30¢ per transaction

Country: Square is available for businesses in US, Canada, Japan, Australia, and the United Kingdom.

Pros

- Cheaper than some other options

- Easy to use

Cons

- Not available in many countries

- More suitable for in-person sales than online eCommerce

5. WooCommerce Payments

WooCommerce Payments is one of the best free payment gateways for WooCommerce stores. It provides a more convenient checkout process and a more seamless checkout experience, as well as a deeply integrated payment gateway for your store. This WooCommerce payments plugin is available to businesses in the United States who sell products in US currency.

It is also a secure platform for customers to choose for completing transactions without bouncing back.

Fees

- 2.9% + $0.30 per transaction for U.S.-issued cards.

- Those who use cards issued outside the United States will be charged an additional 1% fee.

Country: WooCommerce Payments is currently only available to merchants in the United States who sell products in US dollars.

Pros

- Backed by official WooCommerce team

- Free version available

- User-friendly

Cons

- Only available in the US

- Support US dollar only

Which WooCommerce Payment Plugin Is The Best?

I hope this post has assisted you in deciding which one is best for your online business.

The ideal WooCommerce payment gateway is one that has the lowest transaction costs, is available in your desired region, and gives your consumers a better user experience.

As a result, the payment plugin you use may be influenced by factors such as the location of your store, the origins of your clients, and their preferences. In an ideal world, various online stores offer a variety of payment methods from which clients can select their favorite option.

Given these considerations, my top recommendations are:

- Stripe is the great payment gateway for WooCommerce. It offers a pleasant checkout experience, competitive transaction rates, and is available in 40 countries. It also supports upto 135 currencies all around the world.

- PayPal and Authorize.Net are one of the best payment gateways for swiftly establishing a payment processing system.

These days, cryptocurrencies are increasingly popular, so in addition to the traditional payment gateways, it is so fantastic if you can add crypto payment gateways to your online shop.